Navigating the world of taxes as a landlord can be daunting, but understanding the W-9 form is a crucial step toward smooth tax compliance. This guide provides a clear and concise walkthrough, helping you avoid penalties and ensure accurate reporting. We'll cover everything from why you need a W-9 to how to fill it out correctly and its connection to the 1099-NEC.

Why Landlords Need W-9s

The W-9, or "Request for Taxpayer Identification Number and Certification," is a simple form with significant tax implications. It's how you—and others—legally obtain the tax information needed to report payments to the IRS. This ensures accurate reporting and helps avoid penalties. You'll likely need a W-9 in these situations:

- Independent Contractors: If you hire anyone – property managers, handymen, landscapers – you need their W-9 to report payments accurately. Failing to do so can result in significant penalties. Isn't it better to be safe than sorry?

- Tenants Receiving Government Assistance: In some cases involving government-subsidized housing programs, you might require a tenant's W-9. Always check with the relevant agency for their specific requirements.

- Providing Your Own W-9: You'll need to provide your W-9 when receiving payments that classify you as a contractor, such as when a property management company collects rent on your behalf. This ensures accurate reporting of your rental income.

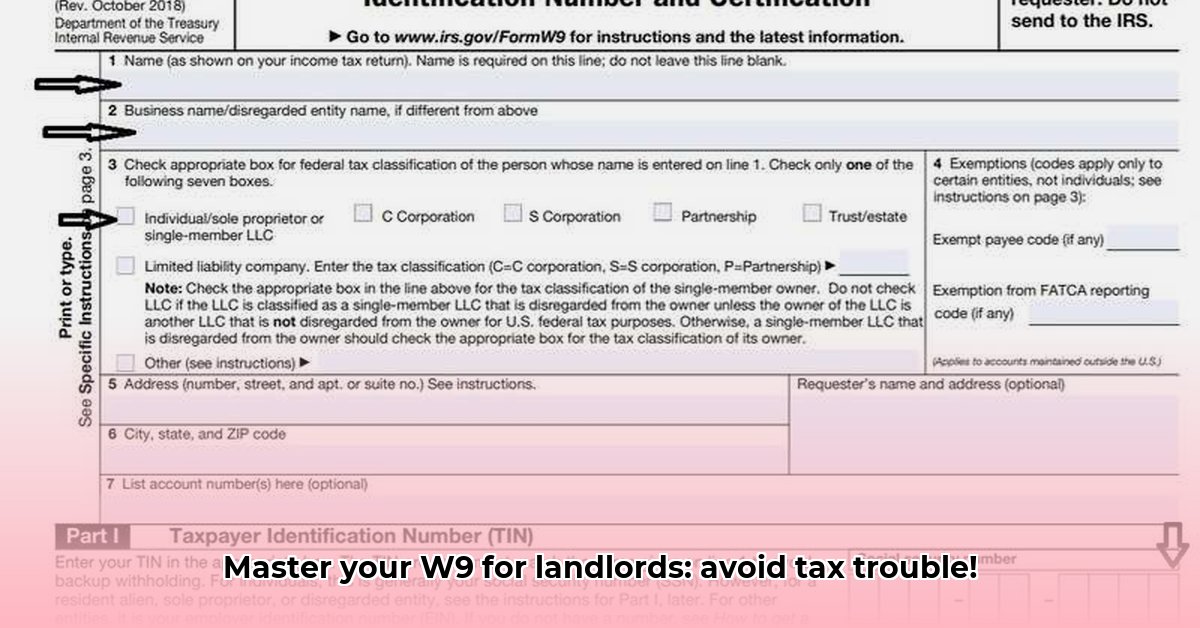

Filling Out Your W-9: A Step-by-Step Guide

The W-9 is straightforward, but accuracy is vital. Let's review each section:

Step 1: Name (as shown on your tax return) Enter your legal name exactly as it appears on your tax filings. Accuracy here is paramount.

Step 2: Business name/disregarded entity name, if different from above If you operate under a business name (e.g., "ABC Rentals"), enter it here. Otherwise, leave it blank.

Step 3: Federal tax classification Indicate your tax status (sole proprietor, LLC, corporation, etc.). Choose the option that accurately reflects your business structure.

Step 4: Exemptions (codes apply only to certain entities, not individuals) Unless you're a tax-exempt organization, leave this blank.

Step 5: Address Provide your complete and current business or home address, matching the one registered with the IRS.

Step 6: List account numbers Generally left blank for rental income. Only complete if specifically requested.

Step 7: Part I – Taxpayer Identification Number (TIN) Enter your Social Security Number (SSN) if you're a sole proprietor, or your Employer Identification Number (EIN) if you're a business entity. Double and triple-check this number!

Step 8: Part II – Requestor's Name and Address The requester fills this out; you don't need to complete this section.

Step 9: Signature Sign and date the W-9. This certifies the accuracy of the provided information. Don't skip this vital step!

Specific Scenarios and When to Request a W-9

Let's clarify situations where you might need a W-9:

When You Request a W-9:

- Independent Contractors: Always obtain W-9s from independent contractors who receive $600 or more in payments during the year. This is crucial for tax compliance and avoiding penalties.

- Tenants with Government Assistance: Some government programs might require a tenant's W-9; confirm this with the relevant agency.

When You Provide Your W-9:

- Third-Party Payments: Provide your W-9 to any entity making payments to you, like a property management company. Doing so ensures accurate processing of your rental income.

Record Keeping: Best Practices for Landlords

Organize your W-9s meticulously. A digital system—cloud storage or a well-organized file—is ideal. Retain these forms and any supporting documentation (leases, payment records) for at least six years for safekeeping.

The W-9 and 1099-NEC: Understanding the Connection

The W-9 is directly linked to the 1099-NEC form used to report payments to independent contractors. If you pay a contractor $600 or more during the year, you must file a 1099-NEC. The information on the W-9 is essential for completing this form accurately. Failure to comply can result in serious penalties. Did you know that penalties for failing to file a 1099-NEC can significantly impact your tax liability?

Conclusion: Prioritize Tax Compliance

Understanding the W-9 is vital for landlords. Accurate completion and record-keeping are critical for avoiding penalties and ensuring tax compliance. If unsure about any aspect, consult a tax professional. Proactive planning is always the best approach to tax matters. Don't underestimate the importance of seeking professional help if you need it; it's a wise investment in peace of mind.